Systematic Investment Plan (‘SIP’ as you know it), is a tool that allows you to invest in Mutual Funds periodically. The other way to invest is lump sum/one-time. SIP is similar to recurring deposits in mutual funds (instead of bank deposits).

SIP has become a buzzword for you and me today because we hear it day in and day out. However, we seldom understand the logic and rationale behind it. It would be prudent for you to understand the underlying theme of SIP and how you can make the most out of it.

Have you seen how these companies have grown in the last 10-15 years?

Kotak Bank

Reliance Industries

HDFC Bank

Page Industries (Jockey)

Eicher Motors (Royal Enfield) etc.

They all have grown 3-20 times in past 15 years. Very few of us could take part in its growth journey by being the shareholder and even fewer could hold it for 10+ years to bear the fruit of multi-bagger returns.

India has a big advantage over most of the other economies in the world i.e. its population and increasing income. We have a 130 crore population and on average, if we increase the income by Rs. 10,000 per person, We would see total income increase by Rs. 13,00,000 crore and GDP will increase by 2-3 times this.

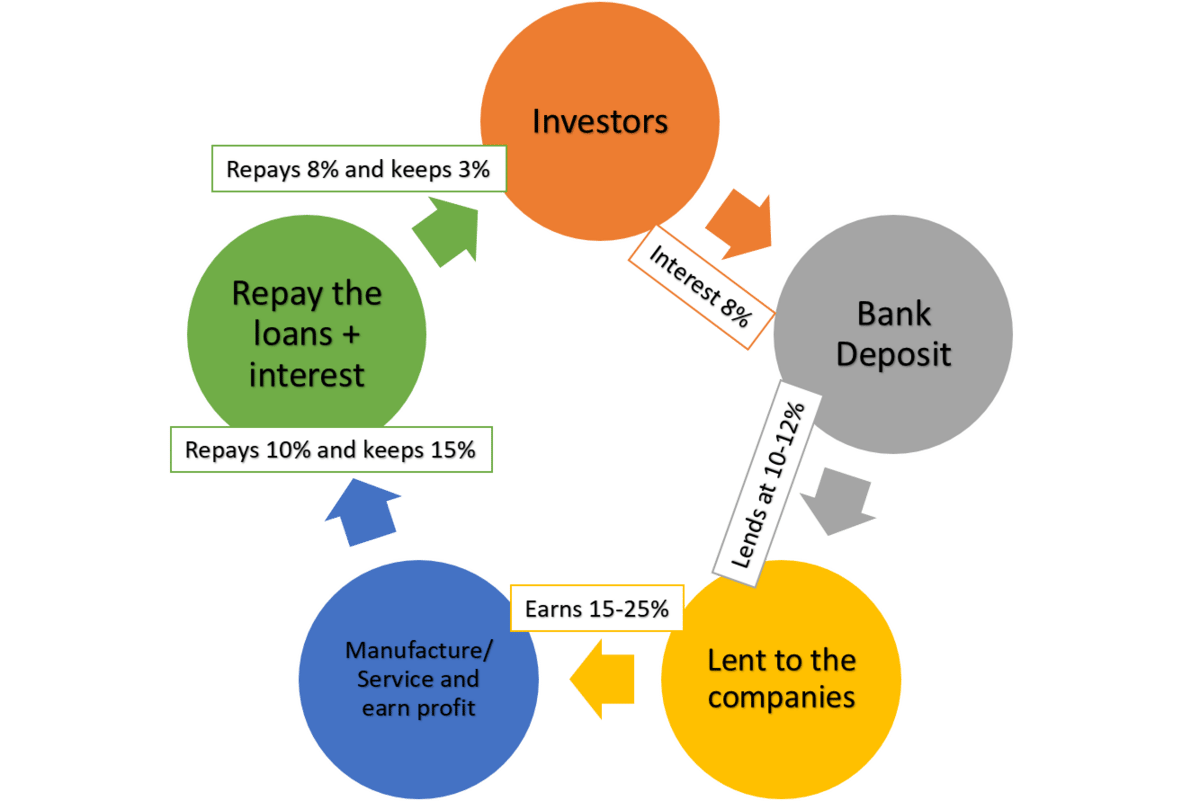

When the income rises, your investments will rise too. Traditionally, you have been part of this journey by investing in bank deposits, and banks in turn would lend it to the companies and companies, in turn, make a profit on this borrowed money and repay the loans along with interest.

Bank deposits shield you from profit/loss but also give you the lowest returns. If you chose to invest directly in these companies, you make the equity return and compound wealth. Now, this difference is significant when you plan for the next 10-15-20 years. Two options to make the most from your investments are:

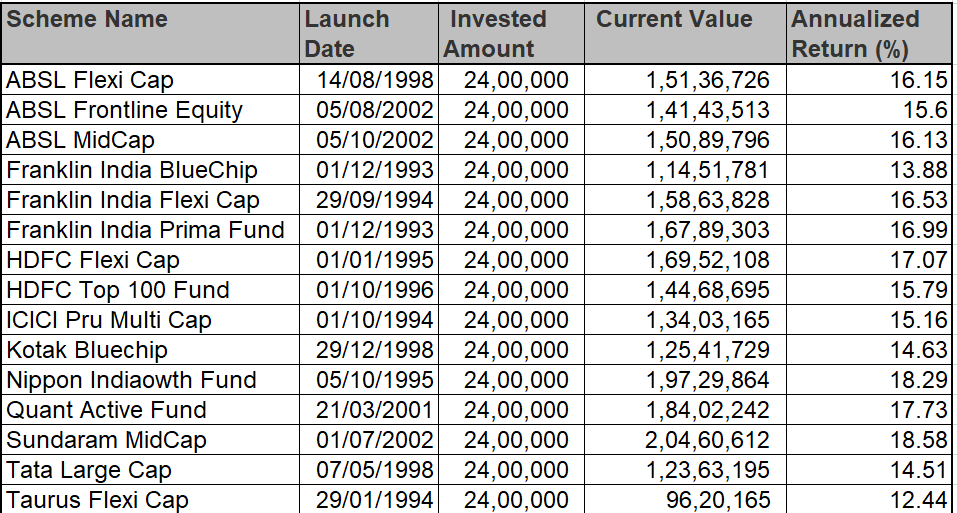

This 15% return is not very hard to achieve, many of the mutual funds have done it over the last 20 years, and many will achieve this over the next 20 years as well. Here are a few of them:

Nippon India Growth Fund is one of the oldest funds and if you would have ignored all the negative news and continued with your Rs. 10,000 SIP, your wealth would have been:

This is enough to demonstrate that SIP works magic when you do it for 15-20-30 years. At Fincare, we have given the best mutual fund schemes that could give similar performance over the next 15-20 years.

I have started this SIP for my daughter in Canara Robecco Small Cap Fund and Union Small cap Fund. I am going to share with you exactly how you can do it yourself when you want to create wealth for yourself.

Step 1- Understand Your Risk Appetite and the Objective of Investment In most cases, the higher the age and financial obligations; the lower the risk tolerance. However, the higher the risk, the higher the return. So, choose appropriately. Step 2- Choose A Mutual Fund For Your Investment You can analyse fund composition and identify based on

Large companies (large cap) / Medium size companies (Midcap) / Small size companies (Small cap)

Schemes Total Asset Under Management (‘AUM’),

Past performance,

Sector composition

You can also drop me an email at [email protected] if you need any help in selecting the right fund.

Step 3- Once you have chosen the mutual fund company, you will have to go through the following steps:

Fill up the application form available on each company’s website such as

or

etc.

Submit a cheque of the monthly SIP amount (future instalments will be automatically debited) (for offline mode) or fill up the ECS form (for online mode).

Provide a cancelled cheque

Select the date of SIP for every month

Provide your Residential proof and KYC form

You can outsource this hassle to my team and get door-to-door service for all your transaction. You can also view your portfolio online on our website with your respective login credentials.

Step 4 - Decide on the Duration of SIP Investment in a mutual fund

Longer the better

Step 5- Stay Invested till the End of your Investment Period

You don’t need to check the daily prices of Mutual funds and should not try to time the market every day.You would now have so many questions - “What ifs” and I will answer all of it below:

What if you want to time the market i.e. buying when the market falls and selling when it goes up?Most likely you will miss the chance of capturing the best return. (Could you invest in 2008 / 2011 / 2015?)What if you default one instalment?It is OK. No penalty from MF (Bank may charge ECS return charge of Rs. 50-150) What if you want to withdraw before the decided term?It is OK. You can withdraw a partial or full amount subject to a 1% exit load (only on instalments of the past 12 months). Any earlier instalments shall be free from any charges. Your SIP still can be continued after you withdraw.What if SIP turns negative?It is OK. Negative right now is an opportunity for higher returns in future. (Refer to the table of NAV above)What if you want to stop a SIP?It is OK. You can stop it any time of the year/month. You need to fill out a form and submit it to your advisor or the AMC. It will take 30 days to stop the instalments. What if I want to restart my stopped SIPs?It is OK. You can restart at any time. Hence, in SIP, everything is OK when you are on your path to making unimaginable wealth. Which club you are in?Rs. 5 crore or Rs. 50 croreI can handhold you through this journey of 50 crores. Simply, email your name and number to [email protected] and I shall call you personally to start your investment journey. You can check our website https://fincareservices.com/ and let us know if you have any queries.

- Tejas LakhaniChartered AccountantFincare Services, Investor, Advisor, FounderEx-PwC, Ex-ACC