- Finance by Tejas

- Posts

- Delegation Is a Leadership Skill — Including With Money

Delegation Is a Leadership Skill — Including With Money

How to grow your wealth with delegation and that's your leadership trait!

Early in every leadership journey, there’s a phase most professionals go through.

You want to control everything.

You read every email.

Sit in every meeting.

Approve things that clearly didn’t need your approval.

It feels responsible.

It also feels heroic.

And then, slowly, it feels… unsustainable.

That’s when good leaders learn a hard truth:

control doesn’t scale — delegation does.

What’s interesting is that while this lesson becomes obvious at work, many highly successful professionals forget it completely when it comes to money.

The Curious Case of the Overqualified DIY Investor

Let’s start with an observation.

Senior professionals, founders, and CXOs are usually excellent at:

Building teams

Trusting specialists

Delegating execution

Focusing on high-impact decisions

Yet when it comes to personal wealth, many revert to:

DIY investing

WhatsApp “forwarded as received” tips

Over-monitoring portfolios

Or postponing decisions indefinitely

Same intelligence.

Same capability.

Different behaviour.

Somewhere between the boardroom and the brokerage account, logic takes a coffee break.

Why Delegation Works in Leadership (And Not Just Because You’re Busy)

In business, delegation isn’t about inability.

It’s about leverage.

Good leaders understand:

Their time is limited

Their attention is expensive

Their role is to decide what, not how

A CEO doesn’t debug code.

A CFO doesn’t design creatives.

And no serious leader insists on doing everything “just to be safe.”

Not because they can’t —

but because that’s the fastest way to become the bottleneck.

Money, inconveniently, works the same way.

When Money Becomes a Side Project

For many professionals, money management lives in an awkward corner.

It’s important — but not urgent.

Complex — but postponed.

Familiar — but rarely structured.

So it becomes a side project:

Look at it when markets move

Act when anxiety peaks

Ignore it when things are calm

This is rarely how leaders run organisations.

Yet it’s how many run their finances.

Not delegating money decisions doesn’t show up as a big mistake on Day 1.

The cost is subtle:

Missed compounding

Inconsistent strategy

Emotional decisions during volatility

Too much action at the wrong time

Individually, these seem harmless.

Over 15–20 years, they become expensive.

Not because returns were poor —

but because decisions were reactive.

In leadership terms, it’s like changing strategy every quarter based on daily feedback.

Delegation ≠ Abdication (This Matters)

Many professionals hesitate here.

Delegation feels like loss of control.

But real delegation is not:

Blind trust

Disengagement

Handing over responsibility

Real delegation is:

Setting direction

Defining outcomes

Reviewing periodically

Letting specialists execute

A good leader doesn’t disappear.

They stop micromanaging.

Money deserves the same maturity.

What Delegation With Money Actually Looks Like

Delegating wealth management doesn’t mean ignoring your finances.

It means:

Clearly defining goals (retirement, freedom, legacy)

Setting risk boundaries

Agreeing on long-term strategy

Reviewing progress without reacting to every fluctuation

In short, it turns money from a daily distraction

into a quiet system that works in the background.

Like good leadership, it’s most effective when it’s boring.

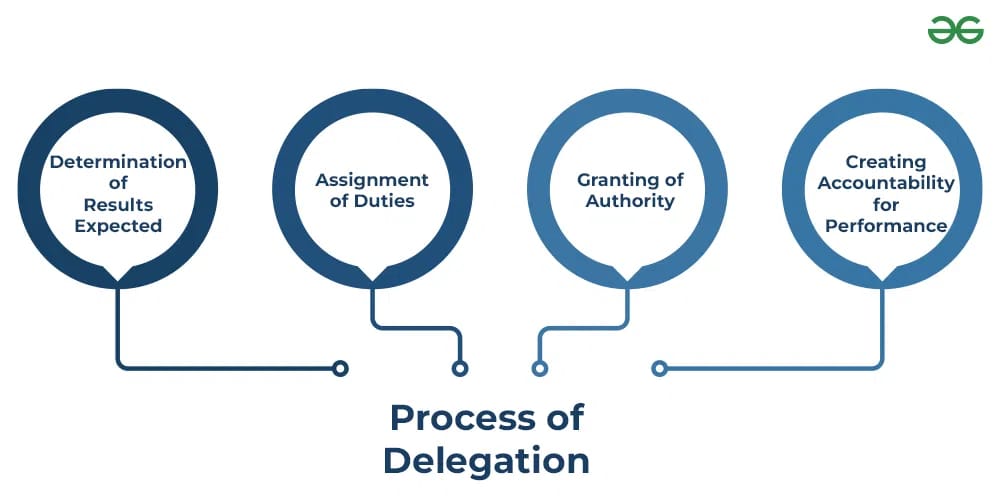

Delegation should be a process

Why High Income Makes This Even More Important

The higher the income, the higher the cost of poor delegation.

Because:

Larger surplus magnifies mistakes

Delays become expensive

Emotional decisions move bigger numbers

High income creates opportunity.

It also creates complexity.

That’s why many high earners feel financially busy —

yet not financially confident.

They’re doing a lot.

Just not always the right things.

A Simple Leadership Test (With Money)

Ask yourself:

Do I review my investments more often than my business strategy?

Do I make money decisions during calm periods or during volatility?

Is my wealth plan documented — or mostly in my head?

If these questions make you slightly uncomfortable, that’s a good sign.

Growth often starts with mild discomfort — not panic.

What Experience Teaches (Quietly)

Over the years, one pattern becomes clear.

Professionals who build meaningful wealth tend to:

Delegate execution

Focus on direction

Avoid reacting to noise

They don’t chase every opportunity.

They don’t respond to every market move.

They treat wealth like an institution —

not a trading account that needs constant attention.

The Leadership Shift That Changes Everything

The moment a leader stops saying,

“I’ll look into this when I get time”

and starts saying,

“This deserves a system”

is the moment wealth management matures.

Because delegation isn’t about losing control.

It’s about choosing where control actually matters.

Closing Thought

Leadership is knowing where your attention creates the highest value.

At work, you’ve already learned that lesson.

With money, the principle is the same.

Delegate wisely.

Review thoughtfully.

And let your wealth compound quietly — while you focus on what you do best.

— Tejas