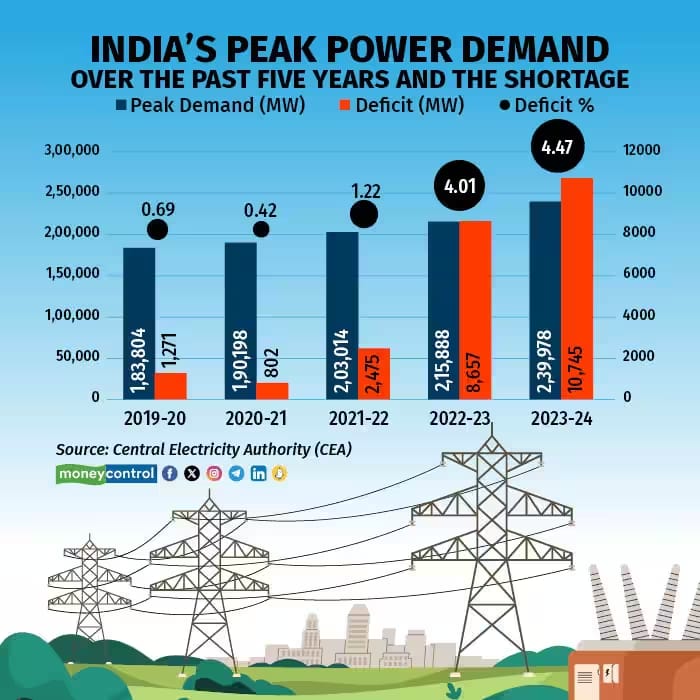

“India faces a high risk of power cuts if the power generation do not keep pace with energy demand.”

Electricity is one such thing that if someone uses it once, they will demand more.

If we look back 20 years, we were consuming less electricity - primarily because we were not dependent on ACs, TVs, Washing Machines, Mobiles etc. But with technological advancement and the upliftment of our standard of living, we are consuming more electricity.

Credit: Moneycontrol

In 2017, the Government introduced “The Pradhan Mantri Sahaj Bijli Har Ghar Yojana - Saubhagya” to bring electricity to every household, whether in rural or urban areas. This resulted in approximately 3 crore households connected to the grid that did not have access previously.

Apart from this, in 2020, the Prime Minister announced a Rs. 20 lakh crore economic package under the ‘AatmaNirbhar Bharat Abhiyaan’, to aid our country out of the Coronavirus crisis (by making us self-reliant). The aim is to make the country and its citizens independent and self-reliant in all senses. He further outlined five pillars of Aatma Nirbhar Bharat – Economy, Infrastructure, System, Vibrant Demography and Demand.

India, a nation on the cusp of transformation, faces both challenges and opportunities in its energy landscape. India is making and will make tremendous investments in the power sector.

India’s Energy Transition: Urgency

To bridge the gap, India must triple its solar and wind capacity, exceeding 500 GW in renewable power generation over the next decade. The nation has allocated ₹2.44 trillion (Rs. 2.44 lakh crores) for this ambitious goal. Wind and solar accounted for 92% of India’s capacity additions in 2022. The urgency lies in meeting this demand sustainably.

Hence, India will also focus on setting up more coal-fired power projects to achieve 24x7 electricity supply for all in 2024. In a reflection of ambitious plans, the Union power ministry has planned a whooping 91 GW of coal-based thermal power generation capacity entailing an investment of Rs 7.28 lakh crore over the next few years.

How to invest in India’s growing Energy Capacity:

Various listed companies could benefit from the opportunity and you could benefit by investing in those companies:

Power Ancillaries

Energy EPC (Engineering Procurement and Construction).

Power T&D

Heavy Electrical Equipments

Energy Efficiency Play – (Manufacturing electrical equipment for Production, transmission and distribution of energy)

Green Energy

Companies going energy Transition

Solar Value Chain

Wind Power Value Chain

Hydrogen Value Chain

Battery Value Chain

Bio Energy value chain

Alternate Fuel

Oil Value Chain

Upstream (Oil Exploration & Production)

Integrated Refining and mining (refineries and marketing)

Standalone Refining

Downstream petrochemicals ( Chemicals and petrochemicals companies)

Base Oil processor (Exploration, production, distribution and transportation and processing of traditional and new energy)

Lubricants and Oil Field Services

Gas Value Chain

Gas Transmission

LNG terminal

City Gas Distribution

Power Value Chain

Coal producer

Power generation

Power transmission

Power trading

If I have to name a few, here are some companies you could look at:

Power Transformer - GE, CGPower

Switch Gear - Hitachi, Siemens

Transmission EPs - Kalpataru, KEI

Grid - Power Grid

Conductors - Apar Industry

Cables & Wires - Polycab, KEI, RR Kabel

Transformers Distribution - Voltamp, TRIL

Wind Turbine - Inox Wind, Timken, Scheffler, TD Power,

I understand these are many companies to understand, determining when to invest, and when to exit is a task. What if you could take exposure to all of them by simply investing in a mutual fund?

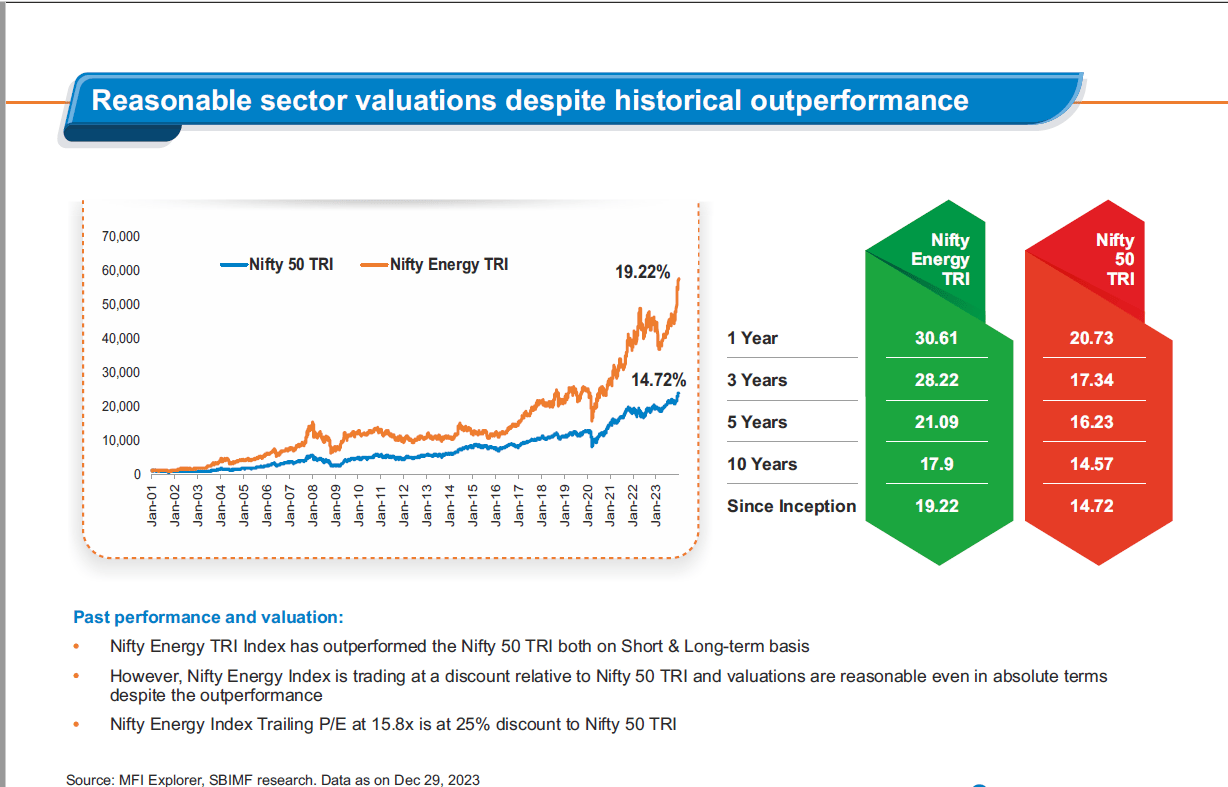

Yes, now there is an option to invest in India’s growing energy segment, which has delivered almost 20% annualised return with still a PE of 15.

Every 3-5 years, there are different sectors that outperform the market, we believe the Power Sector is one such opportunity for the next 3-5 years. If you want to invest in this thematic mutual fund, we would be happy to help you with your investment.

I hope you found this article informative and would love your feedback.

Warm regards,

Tejas Lakhani

PS: Thematic schemes could be volatile in the short term, and the power segment directly depends on the Government’s push for infrastructure spending.