- Finance by Tejas

- Posts

- Nomination & Will: Two Words That Decide Your Family’s Financial Future

Nomination & Will: Two Words That Decide Your Family’s Financial Future

Avoid disputes, delays, and confusion. Understand the real role of nominees and Wills.

There are two things every Indian delays until it becomes urgent:

Health checkups

Declaring who should get their money if they're not around

Second part is very crucial, because we have Nomination and Will which are often misunderstood.

Lakhs of families discover this confusion only after something unfortunate happens. And by then, it’s no longer a discussion. It’s a dispute.

What Most People Believe (But Is Wrong)

“Nominee becomes the owner of the assets.”

Short answer: No.

Long answer: Definitely no.

A nominee is not the heir.

A nominee is not the final owner.

A nominee is not the person who automatically gets everything.

A nominee is simply the person who receives the asset on behalf of the legal heirs.

Why Nomination Still Matters

In 60% of the cases, legal heir is the nominee - may be mother, wife, children, brother etc. However, if there is a dispute regarding legal title of the funds - nominee is always the caretaker.

Without a nominee:

Banks freeze accounts

Mutual funds cannot transfer units

Insurers demand court documents

Family members run between lawyers

Months turn into years

All because one check-box wasn’t ticked. Without nominee, you are required to obtain clear title i.e. Probate from the court and then you can claim the right on the assets.

Nomination ensures smooth transfer, not final ownership.

That itself is priceless during emotionally difficult times.

Nomination Across Different Assets — What Actually Happens

1. Bank Accounts & FDs

Nominee → gets access

Legal Heir → gets final ownership

Banks release funds to nominee first (to avoid operational mess).

But if someone challenges, the nominee must hand over money according to the Will or succession law.

2. Mutual Funds

Nominee simply receives units.

But they become legal owner only if the Will says so.

Today, SEBI has made nomination compulsory to avoid delays.

3. Real Estate

Even if your nominee's name is on society records, it DOES NOT make them the owner.

Courts have reaffirmed this multiple times.

A nominee is required to complete the procedure regarding release deeds, fresh nomination and family settlement agreement/probate in order to obtain the clear title.

4. Insurance

This is the only place where nominee almost always gets full rights — if they are a "beneficial nominee" (spouse, parents, children).

Otherwise, again, Will decides.

So If Nominee Isn’t the Owner, What Decides Everything?

The Will. If Will is not there, then Succession Law.

A Will overrides nomination everywhere except certain insurance cases.

Will = final decision

Nomination = temporary access

You need BOTH.

One ensures speed.

One ensures clarity.

Why You Should Never Rely Only on Nomination

Here’s a real-life scenario:

A man passes away.

Nominee: His younger brother

Will: Leaves everything to his wife

What happens?

The younger brother receives the investments…

But MUST legally hand it over to the wife, because the Will supersedes nomination.

If there is NO WILL, the wife and children become legal heirs under succession law — and the brother becomes a temporary custodian.

Imagine the emotional drama this creates.

Why You Should Never Rely Only on a Will Either

Because:

Without nomination, assets get stuck

Banks freeze funds

Families need a Succession Certificate (can take 4–9 months)

Court fees + legal fees stack up

Mutual fund units remain locked

Your loved ones suffer.

And you lose your chance to make life easier for them.

Nomination vs Will — The Cleanest Summary

Topic | Nomination | Will |

|---|---|---|

Purpose | Smooth transfer | Legal ownership |

Speed | Instant | Slow (court may be needed) |

Final decision | No | Yes |

Mandatory? | Increasingly Yes (for MFs/banks) | No — but SHOULD be |

Can it be challenged? | Yes | Yes, but far stronger |

Who should do it? | Everyone | Everyone above age 18 with assets |

The Smartest Approach? Do Both.

Nomination makes sure money moves quickly.

Will makes sure money moves correctly.

Together, they create:

Zero confusion

Zero disputes

Zero delays

Your family should mourn you — not struggle to access your own hard-earned wealth.

How Often Should You Review?

A simple rule:

Every time your life changes, your Will and nomination must be reviewed.

Marriage

Divorce

Children born

Parents ageing

Buying new property

Starting a business

Investing in new instruments

Your Will is a living document — not a one-time job.

Final Thought

We spend our whole life earning money.

But only 1% of Indians plan properly for what happens after them.

Nomination is a courtesy.

A Will is clarity.

Together, they are your final act of responsibility.

If you truly love your family, don’t leave behind confusion.

If you would like further guidance or want to get the Will made, please revert back.

Warm regards,

Tejas Lakhani

Chartered Accountant

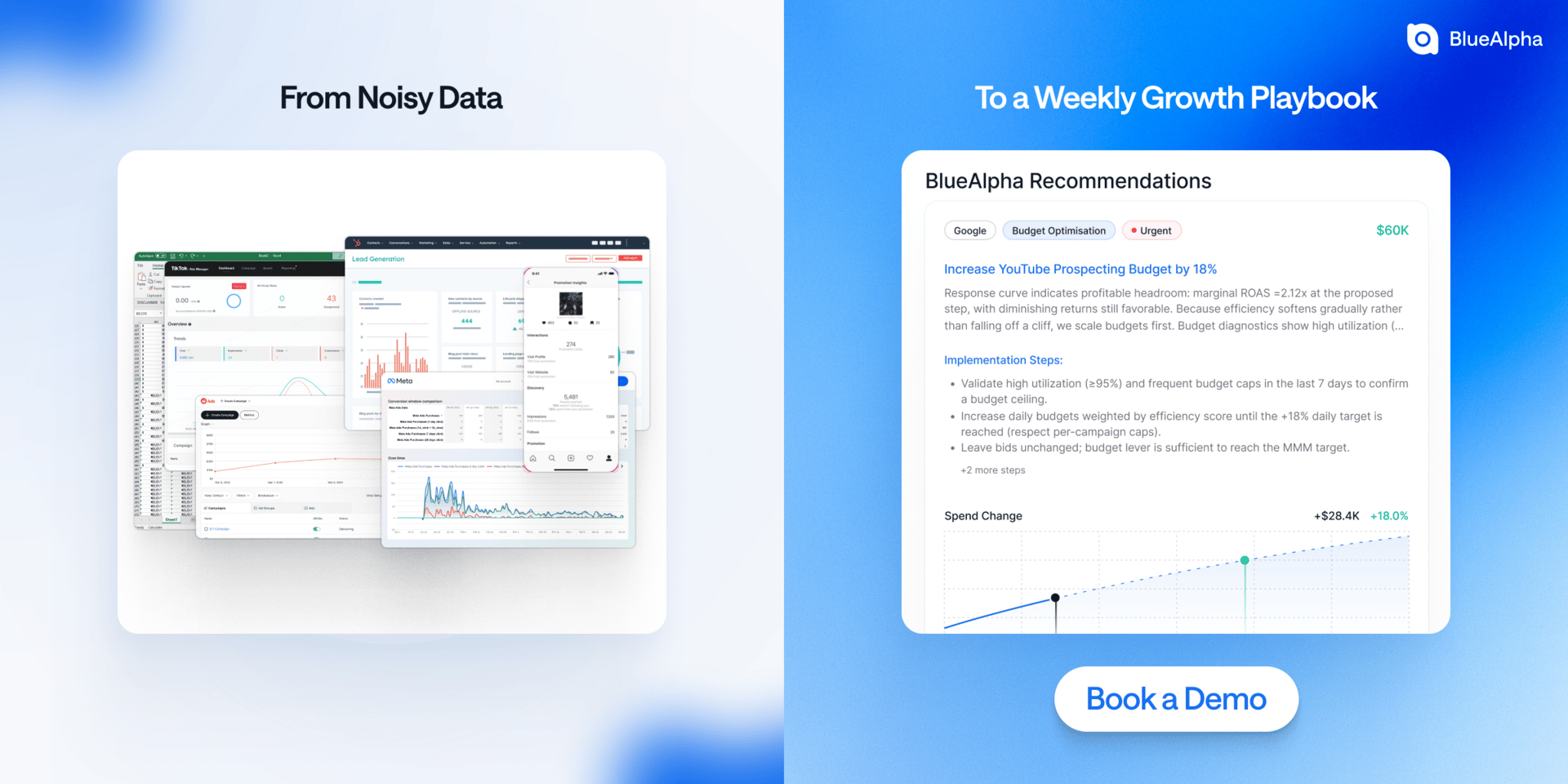

The platform below is the sponsor for this article

Make Every Ad Dollar Work Harder

Great measurement is pointless if you don’t act on it.

BlueAlpha is the AI Action System for Marketing, built to turn noisy data into weekly, campaign-level moves your team can actually take. Not dashboards. Not stale reports. Actions.

Every week, BlueAlpha delivers transparent, trusted recommendations your team can approve in minutes. Reallocate. Scale. Cap. Pause. All backed by Bayesian MMMs, causal tests, and explainable AI from the team that built Tesla’s growth systems.

Brands like beehiiv, MUBI, and Klover, use BlueAlpha to cut waste, compound ROI, and grow faster.