- Finance by Tejas

- Posts

- SIF Explained: Why is it better than FDs?

SIF Explained: Why is it better than FDs?

For people who prefer safety like FD, but better returns

Most investment products force you to choose sides.

- Safety or returns.

- Debt or equity.

I believe we all have adopted mutual fund, PMS and AIFs as our go-to option for equity investing for compounding our wealth.

But there is a part of our wealth that we want to protect it, keep it safe but want interest more than the Fixed Deposit.

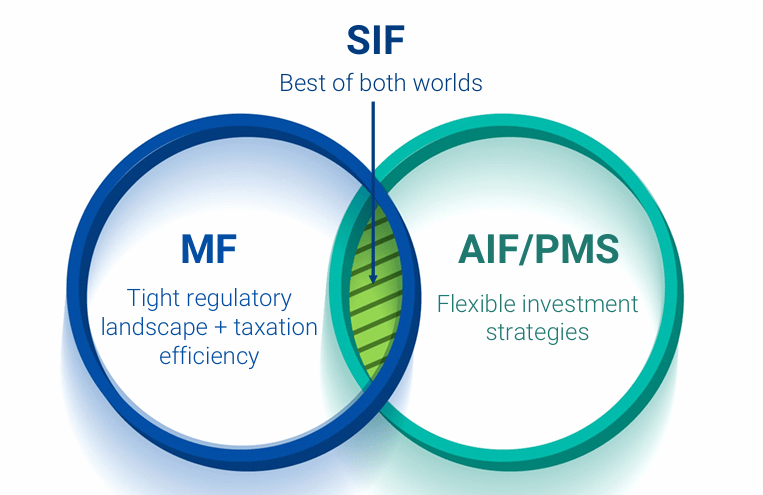

SEBI’s introduction of Specialised Investment Funds (SIFs) marks an important shift. One category in SIF is Hybrid and it is for someone who expects return of 9-11% while keeping the corpus relatively risk-free. SIF is simply the best of both worlds - MFs and AIFs.

One such SIF that has caught our attention recently is Altiva Hybrid Long Short (HLS) SIF by Edelweiss Mutual Fund — designed specifically for investors who traditionally rely on bonds, FDs, and NCDs, but are ready for a smarter evolution.

First, what exactly is an SIF?

A Specialised Investment Fund (SIF) is a new category created by SEBI in 2025.

Think of it like this:

• Same structure as a mutual fund

• Same governance, transparency, daily NAV, taxation clarity

• But with flexibility to use advanced strategies that normal debt or hybrid funds cannot

Minimum investment is ₹10 lakh, which ensures this is meant for serious, long-term investors — not speculation.

What is Altiva Hybrid Long Short (HLS) SIF?

Altiva HLS is designed for investors who traditionally prefer:

• Bonds

• Corporate deposits

• NCDs

• Bank FDs

…but are open to a different way of generating returns with controlled volatility.

As of 18th Dec, the strategy has:

• Crossed ₹1,000 crore AUM

• Delivered ~14.45% annualised returns since inception (Oct 2025)

• Operates under Edelweiss Mutual Fund’s institutional risk framework

This is not a “high return equity product”.

This is an income-plus strategy.

How does the fund generate returns? (Simple explanation)

The fund runs multiple income engines at the same time, instead of relying on just one source.

(1) Fixed Income (Core Stability)

A portion of the portfolio is invested in high-quality debt instruments — similar to bonds — providing a stable base.

Think of this as the FD-like backbone.

(2) Arbitrage + Covered Call (Extra Yield Without Directional Risk)

This is where intelligence kicks in.

• Arbitrage captures price differences between cash and derivatives markets

• Covered calls generate extra income from existing holdings

These strategies do not depend on market going up — they work on inefficiencies.

You can think of it as earning rent on your capital.

(3) Special Situation Trades (Opportunistic but Controlled)

The fund selectively participates in:

• Corporate actions

• Event-driven opportunities

• Short-term mispricing

These are defined, risk-measured opportunities, not speculation.

(4) Market-Neutral / Sector-Neutral Derivative Strategies

This is important.

• The fund can take long and short positions together

• Net market exposure remains controlled

• SEBI does not allow leverage in SIFs (gross exposure capped at 100%)

So volatility is managed, not avoided blindly.

Performance in Different Market Conditions

Based on back-tested data from June 2019 to August 2025, the fund’s model performance shows encouraging stability and consistency. Rolling 2 year return over last 6 years is 10.10% on an average.

Back-tested result of the strategy

The Altiva Hybrid Long-Short Fund is constructed as an “all-weather” portfolio capable of adjusting across market phases. The results suggest low short-term volatility and strong 1–2 year CAGR potential, outperforming typical short-duration and arbitrage mutual funds after adjusting for risk.

Tax Perspective

12.5% long term capital gain tax after 24 months. The 2-year LTCG period ensures long-term tax efficiency—making Altiva a better post-tax performer than most Category III AIFs, which often suffer from full slab-rate taxation.

Why this matters for FD / Bond investors

Let’s be honest.

FDs and bonds have return gone down and it pinches.

Altiva HLS attempts to solve this by:

Running multiple return strategies simultaneously

Avoiding dependency on interest rates alone

Offering mutual fund–like taxation benefit

Providing liquidity through defined redemption windows

This is not a replacement for emergency funds.

But it can be a replacement for a portion of long-term fixed deposit allocation.

Key operational comfort points (important)

No leverage allowed (SEBI mandated)

Daily NAV disclosure

Same MF taxation framework

No drawdown structure like AIFs

Redemptions allowed as per strategy-defined frequency

Units listed for interval strategies

Let’s compare FDs, MFs and SIF

Aspect | FD | Mutual Fund | SIF (Altiva HLS) |

|---|---|---|---|

Return Nature | Fixed | Market-linked | FD + Market Linked Strategies |

Volatility | Very Low | High (short term) | Moderate |

Inflation Protection | Weak | Strong (long term) | Better than FD |

Tax Efficiency | Low | Medium–High | Medium |

Return Pattern | Linear | Cyclical | Smoother |

Objective | Safety | Growth | Stability + Upside |

Every instrument is useful —

when placed in the right role.

Let’s connect and discuss to understand whether this fits your portfolio.

Warm regards,

Tejas Lakhani

Chartered Accountant & Finance Professional

Fincare Services