“Mutual Funds Sahi Hai”

This popular slogan endorsed by celebrities and legendary investors encapsulates the essence of mutual fund investments. But what makes this statement so true?

A comprehensive study by Whiteoak Capital Mutual Fund on SIPs (Systematic Investment Plans) sheds light on this. The research, based on % XIRR rolling returns on a monthly basis for BSE Sensex TRI from September 1996 to May 2024, reveals that the chances of getting negative returns from SIP investments vanish completely over an 8-year period.

Here’s a breakdown of the findings:

3-Year Period: The lowest return recorded was -36.2%.

5-Year Period: The lowest return improved to -10.5%.

8-Year Period: The returns turned positive at 1.4%.

10-Year Period: The lowest return increased to 4.6%.

12-Year Period: It further improved to 6.2%.

15-Year Period: The lowest return reached 7.4%.

Additionally, the probability of achieving higher returns is significant:

69% chance of getting over 12% returns in 8 years.

79% chance of getting over 12% returns in 10 years.

90% chance of getting over 12% returns in 15 years.

Moreover, the chances of receiving over 8% returns rise to 99% for investment horizons exceeding 10 years, while the chances of receiving over 10% returns are 95% or higher.

This data clearly illustrates why mutual funds, especially through SIPs, are a smart investment choice for long-term wealth creation.

SIP returns

Any investors have four assets to invest in:

Real Estate

Fixed Deposit

Equity

Gold

Fixed Deposits rates were once 12-14%, now hovering at 7-8.5%.

Most investors have one or two investment properties, and any incremental purchase in the nearby location would require a sufficiently large corpus.

Gold and Equity are the only two assets which are volatile, could grow at 12-14%, and even smaller contributions can be made.

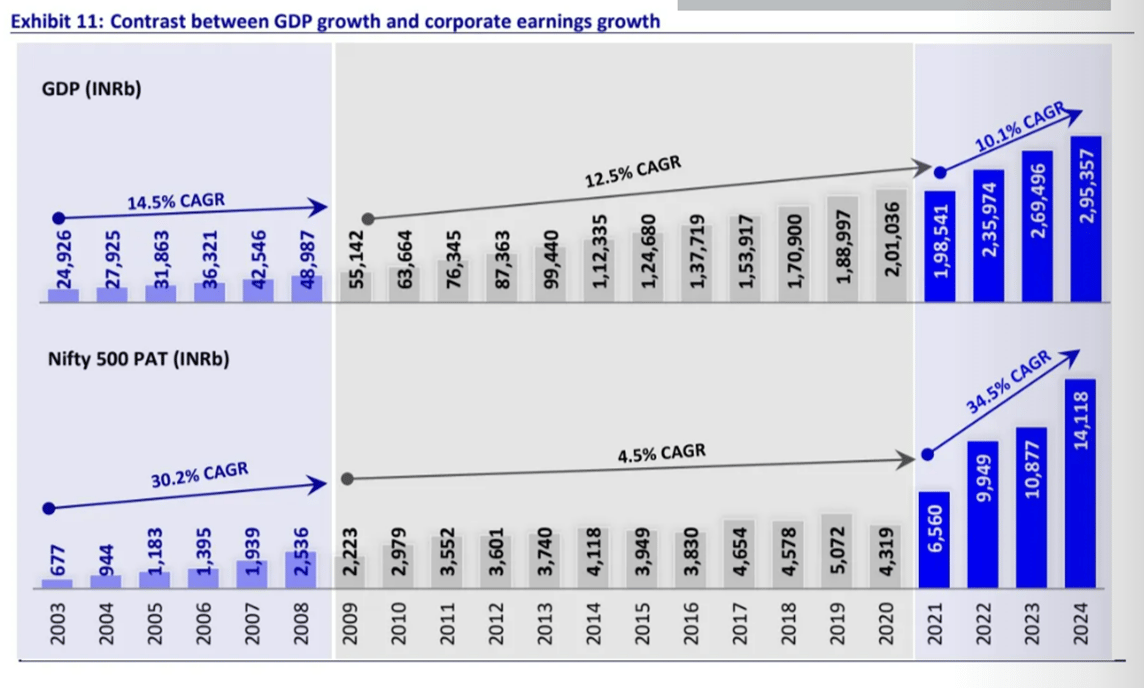

Since 2020, people have significantly invested in equity and all have been rewarded. It is not merely liquidity - the corporate profitability has grown at 34% CAGR for the past 4 years.

Corporate Profitability CAGR

With such compelling data, it's clear that SIPs are not just a smart choice—they are an essential tool for long-term wealth creation. Unlike other investment options, SIPs offer a unique combination of potentially high returns and manageable risk, especially over a longer time horizon.

Think about it: while fixed deposits offer stability, their returns have dwindled over the years. Real estate requires significant capital and carries its own risks. Gold, though valuable, can be highly volatile. Equity, on the other hand, has consistently proven its worth, particularly in the last few years where corporate profitability has grown at an impressive 34% CAGR.

Investing in mutual funds through SIPs allows you to benefit from this growth without needing a large initial corpus. Even small, regular contributions can compound significantly over time, giving you the opportunity to build substantial wealth.

The best time to start an SIP was yesterday. The second best time is now. Don’t wait for the perfect moment—start your SIP journey today and take the first step towards financial freedom and security. With consistent investments and the power of compounding, you can achieve your financial goals and secure a prosperous future.

Take action now and join the many successful investors who have already benefited from the stability and growth potential of mutual funds through SIPs. Your future self will thank you.

Ready to start? Let us help you embark on your SIP journey today! If you already have an SIP, increase it today.

Best regards,

Tejas Lakhani

Chartered Accountant and a finance professional