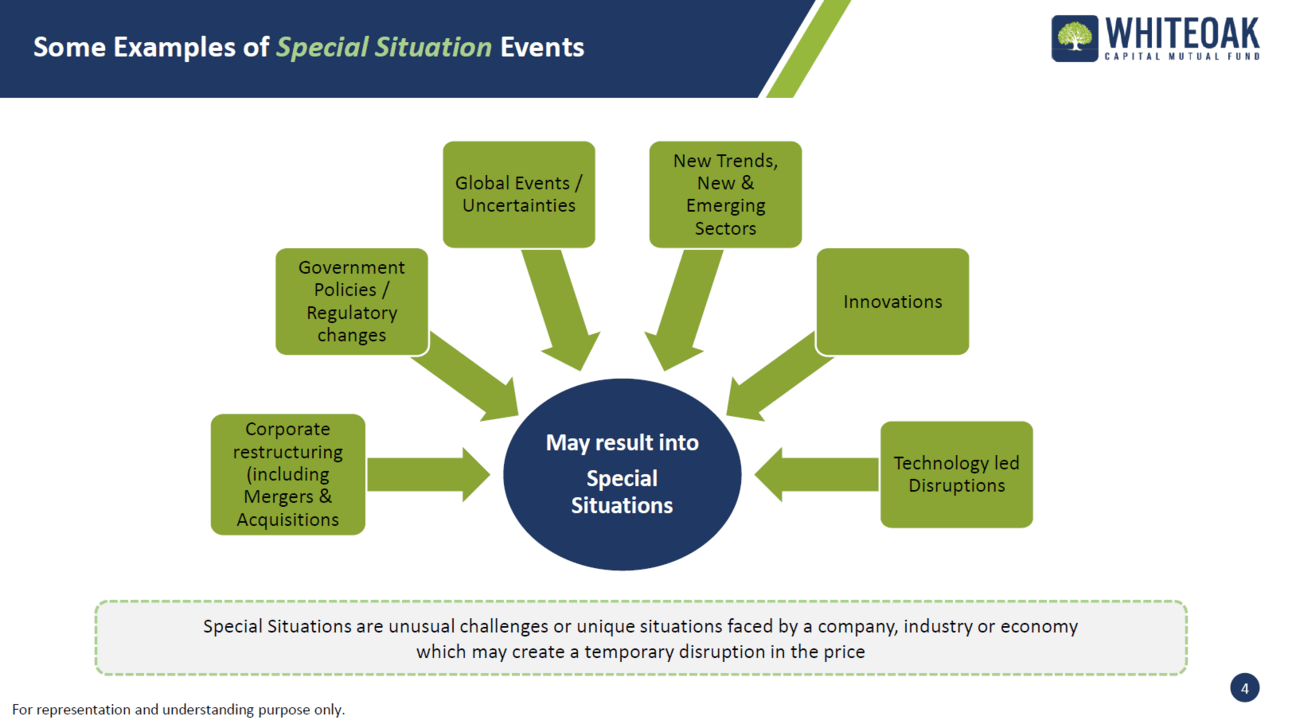

Special Situations are unique situations that present an opportunity to profit from which is a tactical call for an investment. The opportunities can arise due to:

Temporarily and solvable problem impacting the stock price adversely or;

Positive developments are not fully priced in the stock price.

Unfavourable news may lead to a stock’s price decline, and negative sentiments can create uncertainty in the market. The outcome is that the stock of the company starts trading below its intrinsic (fair) value in the short term and that creates a “Buying Opportunity” for the Special Opportunities Fund.

Examples of Special Situation events

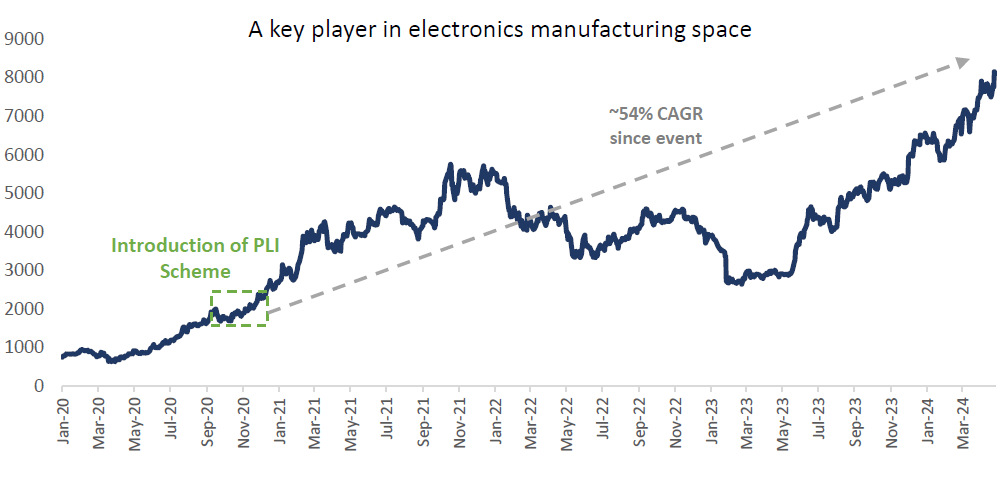

Example of Government Scheme

A leading contract manufacturer of consumer electronics in India. It benefited significantly from the introduction of the PLI (Production-Linked Incentive) Scheme introduced in Oct’20, with an aim to promote domestic manufacturing of electronics and boost India’s capabilities in this sector by providing incentives to eligible companies based on their incremental sales of certain products manufactured domestically.

Company’s existence in the contract manufacturing space, along with superior execution and an agile management team, enabled it to become one of the few players that has taken full advantage of the government’s vision of Atmanirbhar Bharat and localization of electronics manufacturing.

The result - 54% annualised return in the company’s stock price

Impact of PLI on one of its beneficiary

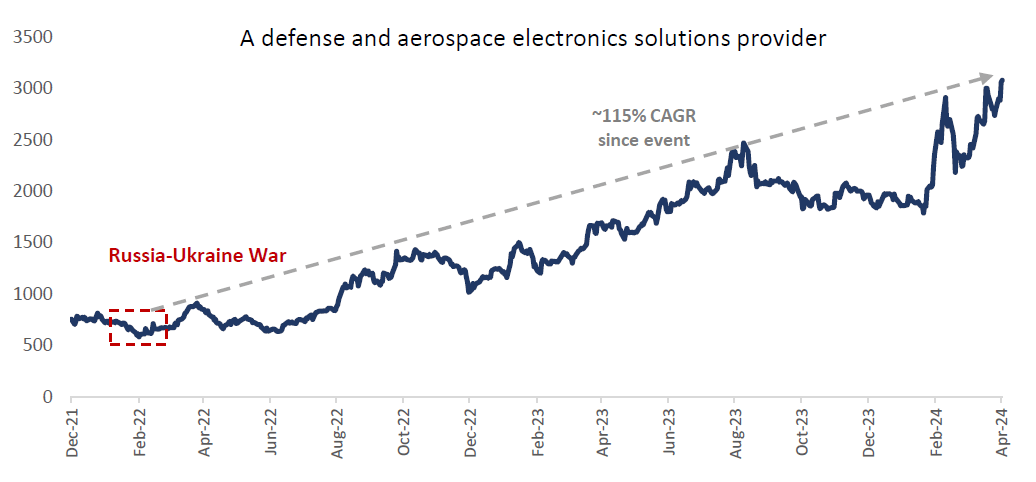

Another example is of Russia - Ukraine War

A vertically integrated defence and aerospace electronics solutions provider catering to the indigenously developed defence products industry. The company focuses on the in-house development of communication, surveillance, and defence systems through innovation, design, and development efforts.

Russia – Ukraine conflict impacted major economies of the world. The growing tensions between these two countries impacted the defence supplies to India. This indirectly helped Indian defence & aerospace companies.

The result - 115% annualised return from a defence and aerospace electronics company

Defence beneficiary

Example of Change in Leadership

The company went through significant changes in the last six years which has led to strong value creation.

The current CEO was appointed in 2017, he made significant changes to the management team by overhauling the existing team with talent from tier-1 companies. All business heads were hired in onsite locations closer to the clients compared to them being in offshore locations previously.

Earlier the company had a geography-based Go-to-market (GTM) strategy where vertical-based domain experience could not be leveraged, which was later changed to a vertical-based GTM approach.

The result - 40% CAGR

Change in senior management

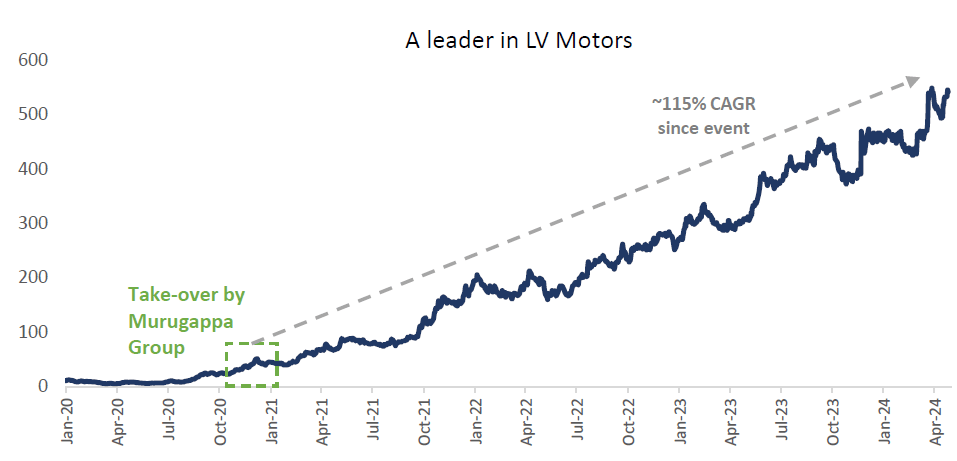

Example of Takeover

A leader in LV motors in India and one of the top suppliers of switchgear and transformers, along with critical components for railways. This company was acquired by Murugappa Group at the end of year 2020.

Earlier the company was suffering due to governance issues under the erstwhile promoters. This takeover marked an important development in Murugappa Group’s diversification strategy, expanding its presence in the power sector through company’s operations.

The company regained market share in core categories such as LV Motors by rebuilding trust with the channel network.

Murugappa Group Takeover

There are countless examples. Some apparently visible large companies and some not so visible but strong mid and small cap companies.

The Equity Market remained eventful in the past and is likely to be eventful in future as well !!

Winston Churchill once said, ”Never let a good crisis go to waste”. Hence, there is an opportunity to make an investment via the mutual fund route. This investment could give an incremental return in the portfolio. Whiteoak manages Rs. 65,000 crores of equity investment in India.

Being a New Fund Offering (NFO) - the last date to opt in is May 29, 2024.

To invest, simply reply to this email and we shall take it forward.

Warm regards,

Tejas Lakhani

Team Fincare