Picture this: you’re at a dinner table with old friends. Everyone’s talking markets. One person casually says, “I had picked Infosys in the 90s, just ₹10,000 back then… today it’s worth crores.”

You smile, nod politely, but deep down you wonder — how does one company multiply wealth like magic while others barely move the needle?

The truth is, it’s not just about numbers, industries, or cycles. The secret often lies in who is steering the ship. And history tells us this — when the person at the helm is the founder, the company behaves very differently.

India: A Nation of Founders

India’s economic story has always been an entrepreneurial one. Narayana Murthy and Nandan Nilekani scripting the IT revolution with Infosys. Uday Kotak building one of India’s most respected banks from scratch. Dilip Shanghvi creating Sun Pharma, which disrupted the global pharma scene. Bajaj Finance, Asian Paints, Berger Paints, Eicher Motors — all founder-driven, all consistent compounding machines.

And if you think this is old history, think again. The baton has passed to a new generation. Nykaa (Falguni Nayar), Zomato (Deepinder Goyal), Paytm (Vijay Shekhar Sharma), Mamaearth (Varun & Ghazal Alagh), PolicyBazaar, CarTrade — all founder-led and listed in recent years. You may debate their valuations, but you cannot deny one fact: India’s entrepreneurial spirit is alive, roaring, and now accessible to every investor through the stock market.

The Data Doesn’t Lie

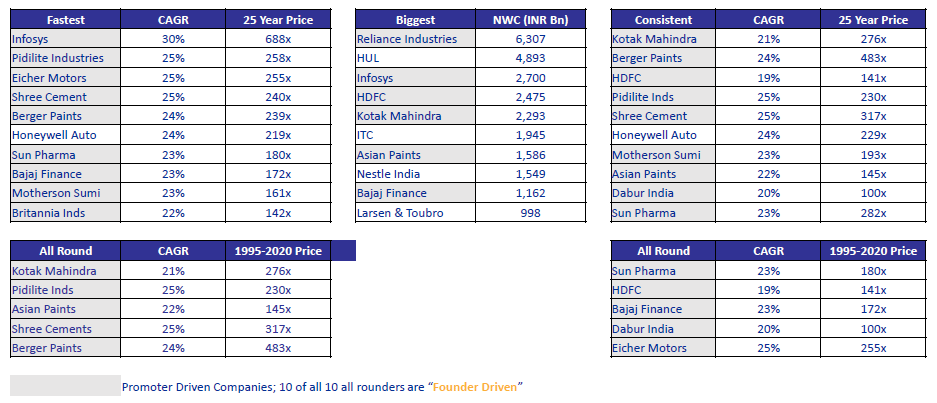

Raamdeo Agarwal’s 25th Wealth Creation Study looked at 25 years of Indian markets (1995–2020). The findings are astonishing:

Wealth Creation Study

9 out of 10 fastest wealth creators were founder-driven.

6 out of 10 biggest net worth creators were founder-driven.

9 out of 10 consistent wealth creators were founder-driven.

10 out of 10 “all-rounders” (fastest, biggest, and most consistent) were founder-driven.

Think about that. Over two decades of wealth creation, professional managers, MNCs, and PSUs all had their chance. But time and again, founder-led companies outperformed every cohort.

Why? Because when you own shares of a founder-driven company, you aren’t just buying stock. You’re buying into a dream, a fire, a legacy. A founder’s personal identity is tied to the business. Their wealth, reputation, and future are inseparable from the company’s success. That intensity simply cannot be replicated by even the best professional managers.

Proof is in the Compounding

Just look at the numbers:

Company | 25-Year CAGR | Wealth Multiplied |

|---|---|---|

Infosys | 30% | 688x |

Pidilite | 25% | 258x |

Eicher Motors | 25% | 255x |

Shree Cement | 25% | 240x |

Berger Paints | 24% | 239x |

Bajaj Finance | 23% | 172x |

Sun Pharma | 23% | 180x |

If you had simply backed these entrepreneurs early and held on, your money would not just have grown — it would have transformed your life.

Harnessing the Power of Founders with Discipline

This is where structured investing comes in. At Fincare Services, we help investors participate in India’s entrepreneurial journey through the Motilal Oswal Founders Fund Series VI — a Category III AIF that focuses exclusively on founder-driven companies.

Investment Universe: Top 500 companies by market cap

Filter: Minimum 26% promoter holding or significant ESOP ownership by top management

Financial Strength: Profitable companies with at least ₹100 crore PBT and RoCE above 15%

Focus: High-quality management, strong business models, and earnings growth above benchmark

The idea is simple: harness India’s entrepreneurial energy in a disciplined, data-driven way.

Past Performance Speaks

The Motilal Oswal Founders Strategy has consistently delivered alpha over the market:

Period | MO Founders Strategy | BSE 500 TRI | Alpha |

|---|---|---|---|

1 Month | 10.8% | 3.5% | +7.2% |

3 Months | 24.7% | 14.6% | +10.1% |

1 Year | 22.6% | 8.5% | +14.0% |

2 Years | 35.2% | 20.9% | +14.3% |

Since Incep | 38.8% | 24.1% | +14.7% |

Clearly, when you focus on founders, you focus on the heartbeat of wealth creation.

Closing Thought

As investors, we all want to be part of India’s growth story. The question is: do you want to bet on caretakers, or on empire-builders?

Because if history — and the future — are any guide, the real wealth in India will always be written by founders.

Details about the fund:

Minimum Contribution: Rs. 1 crore

Redemption: Monthly window to exit

Exit load: 1% upto 12 months, NIL thereafter

For more details and discussion, feel free to revert back to us. We can take you through entire process for your wealth creation.

Warm regards,

Tejas