Tax 2023-24

Every individual earns income - in one way or the other. If you do not plan accurately, you may get an income-tax notice from the department. And so one must be aware of tax implications on all the tax related provisions.

As a Wealth guide and a Chartered Accountant, I often get asked by my clients about tax-related planning. General questions are about tax slabs, the applicability of income tax or capital gain on property/mutual funds/ shares. I have prepared this short reckoner. If you like it, do let me know.

The government introduced the new tax regime that will become the default tax system over the passage of time, while the old one is still available to the taxpayers. The government intends to phase out all the deductions and exemptions and provide simplified tax slabs.

What are the Different Types of Taxable Incomes in India?

Income from Salary or Pension

Income from Businesses: Normal business income and presumptive taxation (option for a business owner to claim straight away 8% profit on the net turnover or professional to claim 50% profit of the net receipt)

Income from House Property: Rent received from the property let out. Interest on a home loan is deductible in this section. If you have an extra house not which is not rented, you still need to show the notional value of the rent. You will get a deduction of 30% (in place of actual maintenance) and any property tax PAID.

Income from Betting, Lottery, etc.

Income from Capital Gain: All assets and investments (except FDs) will attract capital gain if you have any profit/loss on it. Though these gains are also a part of the income tax, they are not added to the taxable amount.

Income from Other sources: It covers interest, commission, pension, dividend etc.

When to file an income tax return?

For NRI: If there is any income (even if Rs. 10,000) in India, you need (mandatory) to file the income tax return.

For Resident Indian: If your taxable income exceeds Rs. 2.5 Lakhs, filing an income tax return is mandatory.

New Tax Slab:

Tax slab as per new regime for AY 2024-25 (FY 2023-24)

There is a surcharge of 10% levied against individuals who earn between ₹50 lakhs to ₹1 crore. A 15% tax surcharge is applicable on individuals with an annual income of over ₹1 crore. 25% if your taxable income falls between ₹2 Crore to ₹5 Crore. Health and Education Cess applies at a rate of 4% of the income tax amount (tax+surcharge amount).

However, if your taxable income does not exceed ₹7 Lakhs in the year, you can claim a rebate under Section 87A. This section allows a rebate of up to ₹25,000 on your tax liability before cess and surcharge.

What deductions and exemptions are not allowed in the new tax regime?

Leave Travel Allowance

Conveyance allowance

House Rent Allowance

Professional tax

Deduction under Chapter VI-A deduction (80C,80D, 80E etc.) (Except Section 80CCD(2) i.e. NPS)

Interest on housing loan (Section 24)

Other special allowances (Section 10(14))

Which regime is better?

If you do not have a housing loan, and are in a 30% tax bracket, in most cases, a new regime will be better.

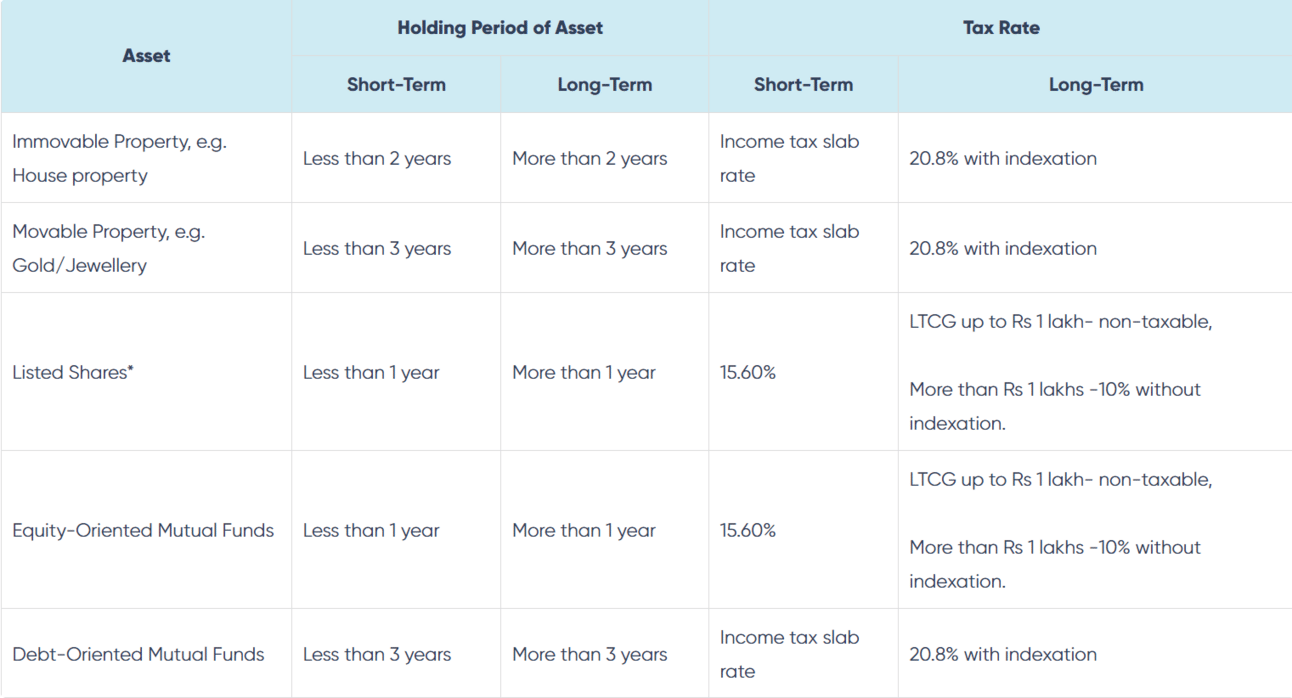

Capital gain nuances?

Every individual owns some asset be it in the form of any property, gold, jewellery or shares. And so one must be aware of tax implications on the gain/loss arising from the sale of such assets.

Long term or short term assets:

Definition of long term and short term assets

(Tax rates mentioned above are excluding a surcharge at 10% on income between Rs 50 lakh and Rs 1 crore and at 15% on income above Rs 1 crore)

In all the assets (except listed shares and equity mutual funds), you will get the benefit of indexation.

Planning your income and reporting it to the income tax department is a crucial step to ensure your financial compliance and security. You don’t want to miss out on any tax benefits or face any penalties for incorrect or incomplete filing.

If you need any help or guidance with your income planning and tax filing, you can rely on Fincare, a trusted and experienced firm that specializes in wealth management and accounting. I am a qualified investment professional and a chartered accountant with Fincare, and I have helped thousands of people like you to achieve their financial goals and optimize their tax savings.

Fincare has been in the industry for over 30 years, serving more than 1,500 clients across various investment and insurance products. We have the expertise, the resources, and the passion to help you grow and protect your wealth.

If you are interested in learning more about our services and how we can help you, please contact us at [email protected] or call us at +919773687483. We would love to hear from you and assist you with your financial needs.

Thank you for reading this blog post and I hope you found it useful. Please share it with your friends and family who might benefit from it as well. Stay tuned for more updates and tips on financial planning and tax filing. Have a great day! 😊

You can also read my other posts:

Most important things to take care of before you retire