mutual fund

Taxes

+1

Oct 16, 2024

•

4 min read

Why UAE NRIs don’t pay capital gains tax on Mutual Funds (MFs) in India

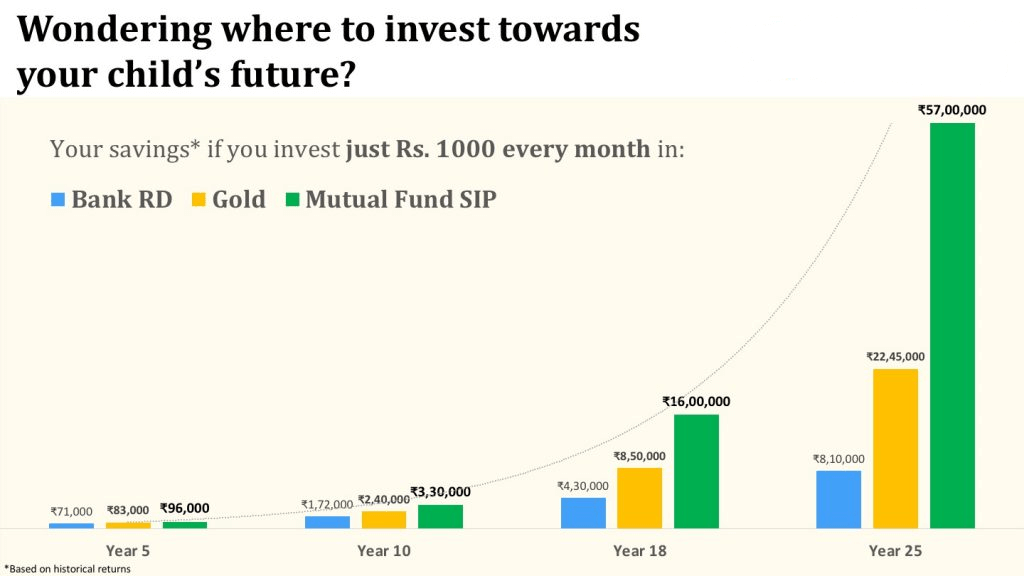

UAE Non-Resident Indians (NRIs) are exempt from paying capital gains tax in India on profits from mutual funds under the India-UAE tax treaty. This makes Indian mutual fund investments highly tax efficient for NRI investors seeking to build long-term wealth. Go through this blog to understand why UAE NRIs do not have to pay capital gains tax on their mutual fund investments in India.